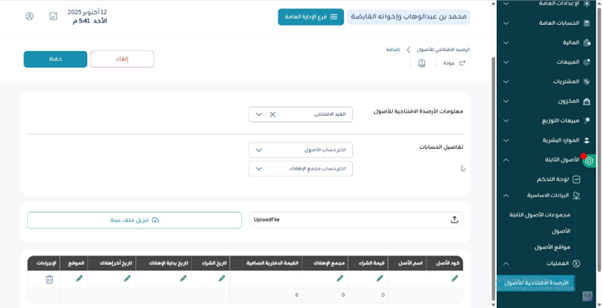

¶ Asset Opening Balances

¶ Usage

Use this screen to load beginning balances for fixed assets when starting a new fiscal year

or when onboarding into the system. Typically you capture acquisition cost, accumulated depreciation,

and the resulting net book value as of a specific balance date.

¶ Fields Description

- Balance Date: The as-of date for opening balances.

- Asset (Code / Name): The asset that the balance belongs to.

- Acquisition Cost: Historical cost carried over from prior books.

- Accumulated Depreciation: Total depreciation up to the balance date.

- Net Book Value: Auto-derived (Cost − Accumulated Depreciation) if supported.

- Location / Cost Center: Optional references carried forward.

- Reference Document / Notes: Supporting evidence and explanations.

¶ Actions

- Add: Insert a new opening line for an asset.

- Edit / Delete: Adjust or remove a line before saving.

- Save: Commit the opening balances.

- Search / Filter: Find assets to initialize by code, name, or group.

¶ System Behaviors

- Once posted, opening balances may be locked to protect prior periods.

- If depreciation is configured, future runs will continue from the loaded balances.

- Audit trail captures user, timestamp, and changes to opening entries.

¶ Expected Outcomes

- Prior-year positions are reflected as opening balances.

- Reports and depreciation schedules start from the correct base.

- Reconciliation to legacy books is supported via reference and notes.